cheaper money car dui

cheaper money car dui

Vehicle insurance plan have great deals of relocating components, and your premium, or the cost you'll spend for protection, is simply among them. Insurance policy is regulated at the state degree, and also laws on called for insurance coverage and prices are different in every state. Insurance business consider lots of different elements, consisting of the state and also area where you live, along with your sex, age, driving background, and the degree of coverage you would love to have.

Here are the greatest aspects that will influence the cost you'll pay for insurance coverage, as well as what to consider when looking at your cars and truck insurance coverage alternatives. There have been some huge adjustments to automobile insurance policy expenses during the coronavirus pandemic.

Service Expert put with each other a list of ordinary automobile insurance costs for each state. Below's an array car insurance expenses by state.

And from Service Expert's data, vehicle insurer tend to bill females extra. Service Expert collected quotes from Allstate as well as State Ranch for standard coverage for male as well as women drivers with an identical profile in Austin, Texas. When switching out just the gender, the male account was priced quote $1,069 for insurance coverage each year, while the women profile was priced estimate $1,124 each year for coverage, costing the woman chauffeur 5% more.

All About How Much Is Car Insurance For 21-year-olds? - Coverage.com

cheaper auto insurance trucks car insurance cheap car insurance

cheaper auto insurance trucks car insurance cheap car insurance

In states where X is a gender alternative on motorist's licenses including Oregon, California, Maine, and also soon New york city insurance providers are still identifying just how to compute expenses - low-cost auto insurance. Average cars and truck insurance costs by age, The number of years you've been driving will certainly impact the cost you'll pay for insurance coverage. While an 18-year-old's insurance policy standards $2,667.

This data was provided to Business Insider by Savvy. How automobile insurance rates transform with the variety of automobiles you own, Somehow, it's sensible: the extra autos you have on your policy, the higher your car insurance costs. However, there are also some cost savings when several vehicles are on one policy.

Automobile insurance policy is less costly in zip codes that are a lot more country, and the very same is real at the state degree. Various other elements that can affect the expense of automobile insurance policy There Additional resources are a couple of other variables that will certainly contribute to your premium, consisting of: If you do not drive lots of miles per year, you're much less most likely to be involved in an accident.

Each insurer checks out every one of these elements and also costs your protection in different ways as a result - cheapest auto insurance. It's critical to compare what you're offered. Get quotes from several different auto insurer as well as contrast them to make certain you're obtaining the most effective deal for you. Personal Finance Reporter.

The The Average Insurance Cost For A 23-year-old Male Driver Ideas

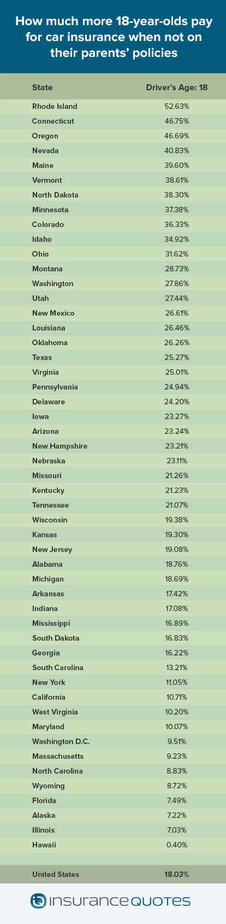

For numerous teenagers, the expense of purchasing auto insurance on their very own may be even more than their summertime tasks can take care of. That's why several parents put teenagers on the household insurance policy, where the expense is a lot less than if a teen acquired his or her own insurance coverage policy. At some factor, nevertheless, young adults come to be grownups as well as their insurance danger level declines - auto insurance.

Is this the time to advise youngsters to take over responsibility and move off their moms and dads' car insurance coverage plan?, for moms and dads to proceed to guarantee children as well as pay the premiums, or for parents to continue to guarantee kids and also have them cover the cost. business insurance.

You could be wondering; The length of time can a child stay on their parents' auto insurance coverage? The truth is, moms and dads can keep youngsters on the family members car insurance plan for as lengthy as they desire, however it might not constantly make financial feeling. Hereof, there are very important aspects to take into consideration (business insurance).

vehicle insurance cheaper car insured car insurance

vehicle insurance cheaper car insured car insurance

Understanding the ideal age to do it is the obstacle (car). Different vehicle insurance coverage prices for teen girls and also young boys Teens on a family members's car insurance coverage will certainly be rated greater and also in a different way, based on their sex, than older grownups. "If 2 moms and dads have boy-and-girl fraternal twins, each getting their chauffeur's permit at the same time, the girl will at first receive a much better price than the boy, based on analytical information indicating a reduced threat of crashes entailing teenage women," claims Kevin Lynch, assistant teacher of insurance policy at The American University of Financial Solutions in Bryn Mawr, Pennsylvania.

What Does Average Car Insurance Rates By Age And State (April 2022) Mean?

Kids might not have conventional grown-up prices up until they get to age 25 if they have a tidy driving document. Despite sex, showing your teenagers safe driving is of the utmost relevance, both for insurance rates as well as their safety - credit score. Here are some teen driving safety tips to aid you begin.

"My son relocated to Texas after college, where vehicle insurance policy is a great deal cheaper than it remains in New York," says Hartwig. "He had a work and also might manage his own insurance now." Reevaluate your car insurance coverage after graduation Numerous moms and dads typically choose to maintain teenagers on the household's vehicle insurance coverage till they graduate from college, assuming they discover work as well as live far from house.

If the youngster can pay for paying for his or her very own car insurance, this is the time for the family members to rest down and speak regarding it. "An agent has the risk and also insurance experience to assist with a talk on the different kinds of insurance policy protections that exist in the market as well as the relevance in purchasing for insurance, contrasting and contrasting the terms, conditions and costs of various policies," he claims - car insurance.

Car insurance for brand-new vehicle drivers can be costly. accident. For the youngest brand-new motorists between the ages of 17-20, yearly insurance policy premiums average around 1,800 and while vehicle insurance coverage for 21-25 years of ages isn't as costly, it still costs typically extra than 1,000. Why is it so costly for these groups? And what can you do to reduce the costs and also obtain the best rate? Read on to discover whatever you need to find out about automobile insurance for new vehicle drivers.

Crossing Lines — A Change In The Leading Cause Of Death ... Can Be Fun For Everyone

Vehicle insurance policy for brand-new as well as young chauffeurs is so expensive since they're viewed as high threat chauffeurs. According to statistics they are most likely to be associated with a crash when driving as a result of absence of experience or as a result of inadequate standards of driving i. e. insolence, drink/drug usage or cellphone usage - cheaper.

The newest stats from AA as well as the Department of Transport show that young motorists are a 3rd most likely to die in a mishap contrasted to even more skilled chauffeurs which 23% of all young motorists are involved in an accident in their initial 2 years of driving.

Having actually just spent for weeks (sometimes months) worth of driving lessons, a driving examination as well as the prospect of maintenance, auto tax and gas on the perspective, expensive automobile insurance is the final nail in the financial coffin. Therefore, it is essential brand-new vehicle drivers attempt to reduce the financial concern of car particularly as the bulk are young chauffeurs without high revenue or a lot in the method of financial savings (vehicle insurance).

There are 3 different tools that are made use of in this sort of insurance coverage: Black box this is where your insurance coverage supplier mounts a black box (like in airplanes) in your vehicle, which is then made use of to track your driving through GPS. Plug-and-drive comparable to black box gadgets, plug-and-drive tools track your driving through general practitioner however as opposed to being set up by your insurance company it just links into a billing point/cigarette lighter.

Fascination About How Much Is Auto Insurance For A 16-year-old?

As you can see from the table below, black box/telematics insurance policy can result in some significant cost savings for young as well as brand-new chauffeurs, with approximately over 800 conserved for vehicle drivers between 17-19 and also approximately nearly 400 saved for those between 20-24. Credit history: Money, Super, Market However, black box insurance may not appropriate for you due to the fact that it could bring about a rise in costs - insurance.

inspect the T&C s of plans when looking around online for any kind of exceptions/limitations which may affect your choice. Enhance your excess Excess is just how much you can pay for to pay in the direction of the total for any kind of repairs your automobile may require in case of an insurance claim. Enhancing your excess minimizes your costs since not only will the insurer need to release much less cash when it comes to spending for fixings, however due to the fact that it likewise enhances your dependability as a client (car).

We advise running quotes on them all to ensure that you get the cover you require for the rate that best matches you (dui). When contrasting quotes bear in mind that the finest value for money isn't constantly the one with the most affordable price. Make sure to additionally compare the terms of the policies as some will certainly differ in extent of the cover.

Direct, Line as an example prides itself on not being provided on comparison websites. Shop your cars and truck somewhere secure Where you state you keep your car impacts just how much you will certainly pay for insurance coverage and you will certainly be asked this when completing your quote. An insurer will certainly need to know whether or not the auto is parked securely overnight and will certainly ask inquiries connecting to physical address and facilities - credit.

Not known Facts About How Age And Gender Affect Car Insurance Rates - Forbes

In the occasion that you have to park your auto on the street, the insurance company will likely use your postcode to evaluate the danger of the location. This implies you're most likely to be adversely affected if you live in a city or a notoriously rough part of town. secure constantly implies reduced danger and lower costs.

Drive less miles An additional question your insurance coverage provider will ask you when filling in your quote is the number of miles each year you drive usually. This will certainly influence your insurance because the even more miles you drive, the most likely you are to be included in a crash. Because of this your insurance provider will likely price quote a higher premium.

This is just recommended if you have actually enough conserved up and can afford to do so, particularly as the costs are much higher for new as well as young motorists. Regular monthly payments are a lot more pricey than the flat annual amount because they resemble fund settlements where you get the complete cover however don't spend for everything up until the last month of your policy.

Nevertheless, regular monthly repayments can be beneficial due to the fact that it expands the expense which is convenient if you have a whole lot of outgoings or merely can not manage to pay simultaneously. auto. Advanced driving courses look for to additional train chauffeurs and also help them come to be more secure and extra observant while when driving.

Some Known Questions About Are Average Car Insurance Rates Affected By Age?.

While some insurance providers will certainly recognise an innovative driving training course as a step in the direction of becoming a lower-risk chauffeur as well as readjust your costs as necessary, not all insurance firms are alike and also others might not award your effort (auto insurance). s We suggest that you weigh up the cost of the training course as well as the insurance coverage with each other before making a choice.

What is a no-claims reward (NCB)? A NCB is something you accumulate over time as you proceed to drive without claiming on your insurance coverage policy - affordable auto insurance. An insurer might offer a five-years no-claims bonus where drivers that have driven for the last five years or more without asserting on their insurance will certainly be eligible for a decrease in their insurance coverage prices.