That Demands Comprehensive Automobile Insurance Policy? Owners of older, less important cars and trucks usually go down comprehensive insurance.

Do you live in an area with severe weather? If your area is prone to typhoons, twisters, wildfires or other severe weather, thorough car insurance can offer you one less thing to worry concerning in case catastrophe strikes. Do you frequently experience animals while driving? If you live in the mountains or the nation and also frequently stumble upon deer, bears or cows when traveling, detailed insurance policy can be well worth the cost.

Comprehensive insurance policy could aid decrease these costs. Your very own finances are the most significant consideration in whether or not to obtain comprehensive insurance.

The money we make helps us give you access to cost-free credit history and also reports as well as assists us produce our various other excellent devices and also instructional products. Compensation may factor right into how and where items show up on our platform (as well as in what order). Given that we generally make cash when you locate an offer you like and obtain, we attempt to show you uses we assume are an excellent suit for you.

Certainly, the offers on our platform do not stand for all monetary products around, yet our goal is to reveal you Click for info as numerous fantastic choices as we can. If you're looking for automobile insurance coverage, you may be asking yourself whether you require to include comprehensive insurance coverage to your auto coverage. Or perhaps you've recently funded an automobile as well as your automobile finance lending institution requires you to get it - insurance companies.

Some Known Details About Comprehensive Coverage - Auto Insurance

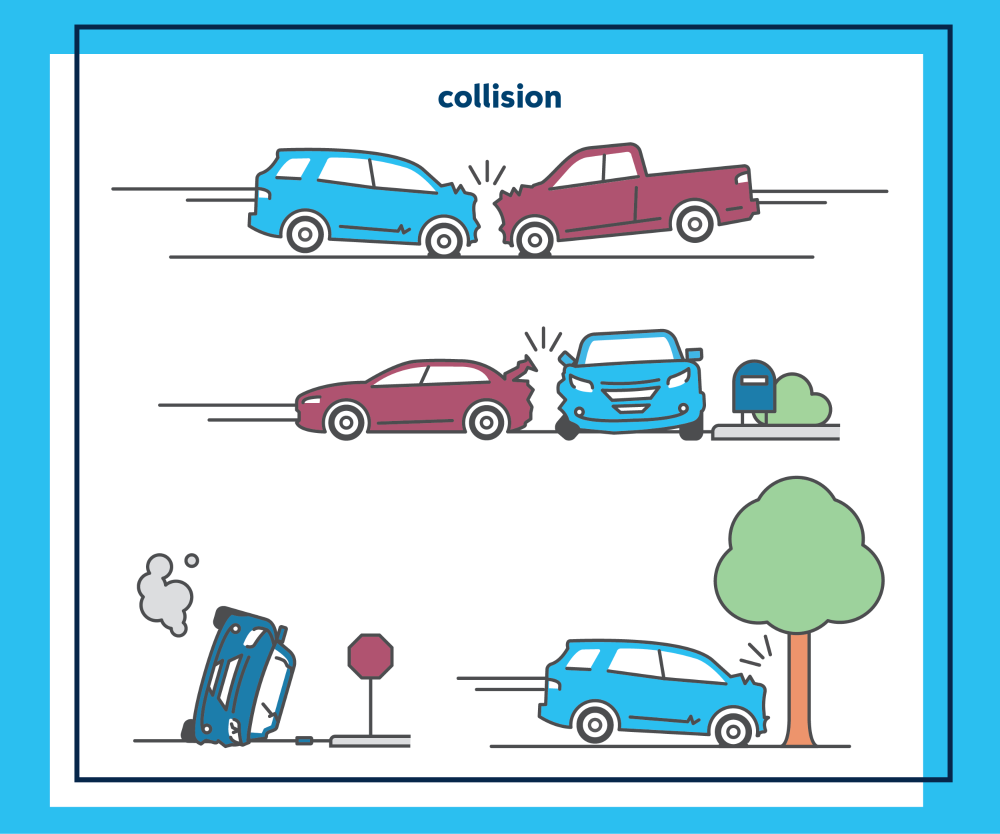

However accident insurance policy supplies extremely different protection from detailed insurance policy. While detailed insurance covers noncollision occasions, accident insurance coverage helps pay for automobile repairs or substitute after your automobile has been damaged in a crash. This can include a crash with another car, a single-car mishap such as a rollover, or a crash with a stationary things like a fence.

insurance company car insurance cheaper cheap

insurance company car insurance cheaper cheap

If you finance or lease your cars and truck, comprehensive coverage will likely be required. If your automobile is paid off, you'll require to determine whether it makes sense for you to acquire this optional protection - business insurance. Comprehensive insurance coverage may be a worthwhile investment if you have a more recent cars and truck as well as wish to help safeguard your financial resources in situation of burglary or damages.

If not, comprehensive protection might deserve the expense for you. If you have an older automobile with a reduced fair market value, you might consider missing extensive coverage as well as decreasing your cars and truck insurance policy costs. To aid you make a decision whether thorough protection would make feeling for you, look up the estimated market worth of your cars and truck.

She has greater than a decade of experience as a writer as well as editor and holds a bachelor's Read a lot more. Read A lot more - cheap auto insurance.

vehicle cheaper car business insurance credit

vehicle cheaper car business insurance credit

Nevertheless, collision insurance does not cover the various other stuff that can bring upon damages on your auto. That's where a comprehensive insurance plan can shield you (car insured). Here's a list of several of the important things a comprehensive policy would cover: Fire and surges, Vandalism, such as when someone secrets or tags your auto, Theft-related damage, for example, damage created when getting into the car, Storms, such as wind, hail storm, hurricanes, floodings, earthquakes and hurricanes, Falling things such as a tree arm or leg falling on a parked auto, or if somebody's transporting products as well as something falls as well as lands on your automobile, Windscreen fractures as well as chips, Animal-related damage, such as harmed brought on by hitting a deer that leaps right into the road, Comprehensive insurance can likewise make life less complicated after your lorry has actually been damaged.

Some Known Facts About Comprehensive And Collision Coverage : Farmers Insurance.

What does extensive insurance coverage not cover? Damages triggered by a collision, Damages triggered to another individual's vehicle, Damages triggered by encountering a fixed things, such as a tree or structure, Medical expenditures incurred by you or other motorists or guests, What is thorough vs. collision? There's an easy means to understand the distinctions in between both kinds of protection.

It depends on the crash, of course, however in many circumstances, it insures you against things within your control. Comprehensive insurance coverage covers you when points besides a car crash damages your vehicle, such as a falling tree branch, a break-in or hailstorm damage from a tornado. These points are taken into consideration past your control.

When your car is swiped, report it to the authorities as well as your insurance coverage company asap. When you have detailed or accident protection from ERIE, your plan might feature some protection for things taken from your vehicle. Check your policy or contact your ERIE Agent for more information - credit score.

That makes good sense: If you're monetarily protected, you're more probable to make on-time funding settlements. Do I need thorough coverage for my older or paid-off vehicle? Once your automobile is settled, having comprehensive insurance coverage is optional - automobile. As your vehicle ages, the total replacement expense of your automobile can be a consider whether you desire to proceed.

If the value of the vehicle is worth less than that total amount, it may be an excellent time to go down detailed. (And placed the financial savings toward your reserve.).

4 Easy Facts About Cost Vs. Benefit Analysis: Comprehensive Car Insurance Shown

cheaper auto insurance cheapest vans trucks

cheaper auto insurance cheapest vans trucks

A comprehensive vehicle insurance is a considerable motor insurance plan that covers the insured person versus both, own problems and any kind of 3rd party liabilities. It is also known as 'own-damage' or a 'apart from collision' vehicle insurance coverage as this policy also shields you financially against any kind of losses that may arise not as a result of accident.

Although detailed cars and truck insurance offers extra coverage than a Third-party cover, it is not essential that a comprehensive cover will always be expensive (cheap). And since you understand what extensive insurance policy for an automobile is you can compare comprehensive vehicle insurance coverage quotes online to check what suits you ideal. A comprehensive car insurance policy is one of the most remarkable type of security you can supply your automobile with.

For that, you have to read it really carefully. Usually, you won't need to bother with the following, as they will be covered under your extensive vehicle insurance policy: Damage triggered by Natural disasters or serious weather, Fire, Burglary, Criminal Damage, Damage to third party, Damage to your lorry triggered by falling things such as trees, Damage or devastation of your lorry caused by an act of civil disturbance such as troubles What Does Comprehensive Insurance Coverage Not Cover? If your car withstands damages as a result of an accident, after that an auto insurance coverage claim can not be made unless you have a comprehensive car insurance.

Nonetheless, if the vehicle is damaged at the exact same time, obligation of the firm will certainly be restricted to 50% of the replacement expense, Loss/ damages to the automobile created by war, mutiny or nuclear risk is the best selection for you if you wish to pamper your car and also give it maximum security.

Crash and comprehensive insurance coverage are two kinds of automobile insurance coverage protections. They are both lawfully optional and pay for the expense of damages to your cars and truck, yet do so in various situations.

Some Known Factual Statements About What Is Comprehensive Insurance? - Beaver Toyota Of ...

What is extensive insurance? Extensive automobile insurance policy pays for problems caused by something besides your auto driving into something else.

If your cars and truck is damaged in a hailstorm as well as the damage costs $900 to fix, you would be accountable for $500 as well as your insurance firm would certainly cover the staying $400. What are the benefits of extensive protection? The major advantage of thorough coverage is that it can provide assurance while you're far from your auto.

Nevertheless, maintain in mind that, like a split bumper or minor vandalism. If a mischief-maker keys your automobile and also the repair service sets you back $600, your thorough plan with a $1,000 insurance deductible will not pay for any of the fixings. It's free, basic as well as safe and secure. What is accident insurance? Collision protection spends for damages to your automobile that takes place as an outcome of a collision.

You'll set this quantity when you acquire your policy. A higher insurance deductible lead to much more cost effective monthly premiums (perks). What are the benefits of collision insurance policy? The primary advantages of collision insurance policy are that you will not need to stress over high fixing expenses after a mishap, if you would be incapable to afford repair expenses or if you merely value satisfaction.

auto insurance insurers car insurance automobile

auto insurance insurers car insurance automobile

If you're relying on the various other driver's liability protection to pay for the damage, you may require to wait on the insurance provider to determine that was at fault. If you file a crash insurance claim and it's later identified that the other driver's liability insurance coverage should pay, you'll typically be repaid immediately - affordable car insurance.

Some Ideas on Comprehensive Car Insurance Explained - Confused.com You Should Know

Allow's utilize the consequences of a typhoon as an instance to illustrate the distinctions between accident and also thorough. Within that storm, let's think about 2 events that may have occurred: A heavy tree branch fell on your auto, or You swerved to avoid a dropping tree branch and also wound up collapsing into a tree.

This sort of mishap would get compensated under your extensive policy. In the second scenario, you were driving the vehicle as well as swerved into the tree, which makes it a crash. As a result, accident insurance policy spends for the problems. Events like the hypothetical ones specified above are why it is necessary to separate in between the 2 types of insurance coverage.

Your lending institution desires to safeguard their financial investment and also make certain there are sufficient funds to enable the chauffeur to fix the lorry if it's damaged. We also suggest you have both detailed and also crash protections if: Your auto is much less than one decade old - cheap auto insurance. Your automobile is worth greater than $3,000.

While the costs of extensive as well as collision shrink over time as your automobile reduces in worth, the lower premium often tends not to equal the reduced possible payout if the automobile is entirely ruined, or completed. What happens if I only get thorough insurance coverage? There is an instance to be created obtaining simply comprehensive and not crash insurance policy, also if your car is not important.

car insurance affordable cars prices

car insurance affordable cars prices

Oklahoma has a very high occurrence of hurricanes, and Arkansas is at risk from serious weather condition including hefty storms. New Mexico, Wyoming as well as Montana are subject to wildfire risk. Some of one of the most noteworthy states for storm danger and also various other natural catastrophes are The golden state, Texas as well as Louisiana.

The Greatest Guide To What Does Comprehensive Insurance Cover? - Honda Universe

Number of vehicle drivers with detailed insurance coverage by state Regardless of the myriad of threats in lots of states storms, flooding, electrical storms, fires approximately one fourth of chauffeurs have picked to avoid detailed insurance. If you have an useful car as well as are in and at-risk location for natural perils, take into consideration comprehensive insurance coverage to shield versus unforeseen risks of damage to your vehicle - insurance company.